Abstract

Short Communication

Nonlinear Numbers to Public Debt Growth through Mathematical Induction

Widastra Hidajatullah Maksoed*

Published: 02 August, 2024 | Volume 7 - Issue 2 | Pages: 122-123

Just as an individual is expected to control his/her debt-to-asset ratio, so is a government expected to control its national debt as a function of the country’s wealth, measured e.g. by its gross domestic product/GDP [1].

Read Full Article HTML DOI: 10.29328/journal.ijpra.1001095 Cite this Article Read Full Article PDF

References

- Petersen AM, Podobnik B, Horvatic D, Stanley HE. Scale Invariant Properties of Public Debt Growth. 2010; 90(3):38006.Available from: http://dx.doi.org/10.1209/0295-5075/90/38006

- Eberhatd M, Presbitero AF. Public Debt Growth: Heterogeneity and Nonlinearity. J.Int.Ec. 2015;97(1):45-58. Available from: https://doi.org/10.1016/j.jinteco.2015.04.005

- Navascues MA. FRctal Approximation. Complex.Anal.Oper.Theory. 2010; 4:953-974 Available from: https://link.springer.com/article/10.1007/s11785-009-0033-1

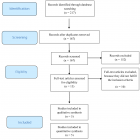

Figures:

Similar Articles

-

High energy HF (DF) lasersVictor V Apollonov*. High energy HF (DF) lasers. . 2018 doi: 10.29328/journal.ijpra.1001001; 1: 001-016

-

Magnetohydrodynamic CNTs Casson Nanofluid and Radiative heat transfer in a Rotating ChannelsZahir Shah*,Abdullah Dawar,Saeed Islam,Muhammad Idress,Waris Khan. Magnetohydrodynamic CNTs Casson Nanofluid and Radiative heat transfer in a Rotating Channels. . 2018 doi: 10.29328/journal.ijpra.1001002; 1: 017-032

-

Sounding procedure for characterization of big fusion reactor chambers by means of a compact neutron source with a nanosecond pulse durationVA Gribkov*,B Bienkowska,S Jednorog,M Paduch,Tomaszewski. Sounding procedure for characterization of big fusion reactor chambers by means of a compact neutron source with a nanosecond pulse duration. . 2018 doi: 10.29328/journal.ijpra.1001003; 1: 033-051

-

Gravitation - Flat Power FieldSA Orlov*. Gravitation - Flat Power Field. . 2018 doi: 10.29328/journal.ijpra.1001005; 1: 067-073

-

Moving space-matter as the basis of the intelligence in the Physical WorldBoris S Dizhechko*. Moving space-matter as the basis of the intelligence in the Physical World. . 2019 doi: 10.29328/journal.ijpra.1001007; 2: 001-003

-

Nanotechnology to improve the biofouling and corrosion performance of marine paints: from lab experiments to real tests in seaGeorge Kordas*. Nanotechnology to improve the biofouling and corrosion performance of marine paints: from lab experiments to real tests in sea. . 2019 doi: 10.29328/journal.ijpra.1001012; 2: 033-037

-

Biological membranes: The laboratory of fundamental physicsSamo Kralj*,Mitja Kralj. Biological membranes: The laboratory of fundamental physics. . 2019 doi: 10.29328/journal.ijpra.1001013; 2: 038-040

-

Biodegradation of gold and platinum implants in rats studied by electron microscopyLudwig Jonas*,Hendrik Kosslick,Hermann Sauer,Tino Just,Ursula Vick,Gerhard Fulda. Biodegradation of gold and platinum implants in rats studied by electron microscopy. . 2019 doi: 10.29328/journal.ijpra.1001014; 2: 041-048

-

Modeling of A.I based Inhalation for Advanced Life Support System DevelopmentMd. Sadique Shaikh*,Tanvir Begum. Modeling of A.I based Inhalation for Advanced Life Support System Development. . 2019 doi: 10.29328/journal.ijpra.1001015; 2: 049-050

-

Bio-moleculear thermal oscillator and constant heat current sourceR Panahinia*,S Behnia. Bio-moleculear thermal oscillator and constant heat current source. . 2019 doi: 10.29328/journal.ijpra.1001016; 2: 051-055

Recently Viewed

-

Sensitivity and Intertextile variance of amylase paper for saliva detectionAlexander Lotozynski*. Sensitivity and Intertextile variance of amylase paper for saliva detection. J Forensic Sci Res. 2020: doi: 10.29328/journal.jfsr.1001017; 4: 001-003

-

Extraction of DNA from face mask recovered from a kidnapping sceneBassey Nsor*,Inuwa HM. Extraction of DNA from face mask recovered from a kidnapping scene. J Forensic Sci Res. 2022: doi: 10.29328/journal.jfsr.1001029; 6: 001-005

-

The Ketogenic Diet: The Ke(y) - to Success? A Review of Weight Loss, Lipids, and Cardiovascular RiskAngela H Boal*, Christina Kanonidou. The Ketogenic Diet: The Ke(y) - to Success? A Review of Weight Loss, Lipids, and Cardiovascular Risk. J Cardiol Cardiovasc Med. 2024: doi: 10.29328/journal.jccm.1001178; 9: 052-057

-

Could apple cider vinegar be used for health improvement and weight loss?Alexander V Sirotkin*. Could apple cider vinegar be used for health improvement and weight loss?. New Insights Obes Gene Beyond. 2021: doi: 10.29328/journal.niogb.1001016; 5: 014-016

-

Maximizing the Potential of Ketogenic Dieting as a Potent, Safe, Easy-to-Apply and Cost-Effective Anti-Cancer TherapySimeon Ikechukwu Egba*,Daniel Chigbo. Maximizing the Potential of Ketogenic Dieting as a Potent, Safe, Easy-to-Apply and Cost-Effective Anti-Cancer Therapy. Arch Cancer Sci Ther. 2025: doi: 10.29328/journal.acst.1001047; 9: 001-005

Most Viewed

-

Evaluation of Biostimulants Based on Recovered Protein Hydrolysates from Animal By-products as Plant Growth EnhancersH Pérez-Aguilar*, M Lacruz-Asaro, F Arán-Ais. Evaluation of Biostimulants Based on Recovered Protein Hydrolysates from Animal By-products as Plant Growth Enhancers. J Plant Sci Phytopathol. 2023 doi: 10.29328/journal.jpsp.1001104; 7: 042-047

-

Sinonasal Myxoma Extending into the Orbit in a 4-Year Old: A Case PresentationJulian A Purrinos*, Ramzi Younis. Sinonasal Myxoma Extending into the Orbit in a 4-Year Old: A Case Presentation. Arch Case Rep. 2024 doi: 10.29328/journal.acr.1001099; 8: 075-077

-

Feasibility study of magnetic sensing for detecting single-neuron action potentialsDenis Tonini,Kai Wu,Renata Saha,Jian-Ping Wang*. Feasibility study of magnetic sensing for detecting single-neuron action potentials. Ann Biomed Sci Eng. 2022 doi: 10.29328/journal.abse.1001018; 6: 019-029

-

Pediatric Dysgerminoma: Unveiling a Rare Ovarian TumorFaten Limaiem*, Khalil Saffar, Ahmed Halouani. Pediatric Dysgerminoma: Unveiling a Rare Ovarian Tumor. Arch Case Rep. 2024 doi: 10.29328/journal.acr.1001087; 8: 010-013

-

Physical activity can change the physiological and psychological circumstances during COVID-19 pandemic: A narrative reviewKhashayar Maroufi*. Physical activity can change the physiological and psychological circumstances during COVID-19 pandemic: A narrative review. J Sports Med Ther. 2021 doi: 10.29328/journal.jsmt.1001051; 6: 001-007

HSPI: We're glad you're here. Please click "create a new Query" if you are a new visitor to our website and need further information from us.

If you are already a member of our network and need to keep track of any developments regarding a question you have already submitted, click "take me to my Query."